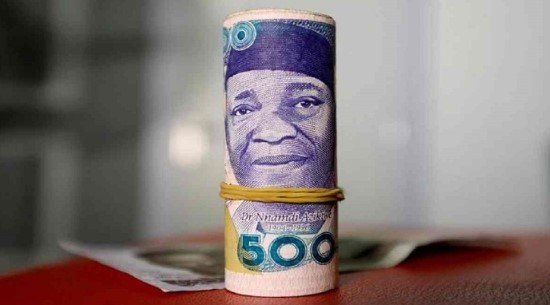

The Nigerian naira has been significantly affected by prevailing market forces, recently plunging to a concerning level of N1,650 per dollar in the official exchange market. This alarming depreciation highlights the ongoing challenges faced by the Nigerian economy, including inflationary pressures, foreign exchange shortages, and shifting investor sentiment. The naira’s decline has sparked discussions about the underlying factors contributing to this trend and its implications for businesses and consumers alike.

Understanding the Decline

The recent drop of the naira to N1,650 per dollar is a reflection of multiple economic factors at play. One of the primary drivers is the persistent inflation that has plagued the Nigerian economy in recent years. High inflation erodes the purchasing power of consumers and increases the cost of goods and services, leading to a strained economic environment. As prices rise, the demand for foreign currency increases, placing additional pressure on the naira.

Additionally, Nigeria has been grappling with a foreign exchange crisis, which has created a significant gap between the demand for dollars and the available supply. The Central Bank of Nigeria (CBN) has struggled to maintain adequate foreign reserves, which are essential for stabilizing the naira and supporting international trade. As a result, businesses that rely on imported goods and services are facing increased costs, leading to a further weakening of the naira in the official market.

Investor sentiment has also been impacted by uncertainties surrounding government policies and the overall economic outlook. Many investors remain cautious, leading to reduced foreign direct investment and a withdrawal of capital from the Nigerian market. This has exacerbated the situation, contributing to the naira’s decline as demand for dollars outstrips supply.

**Consequences for the Economy**

The depreciation of the naira to N1,650 per dollar has far-reaching implications for the Nigerian economy. For consumers, this means higher prices for imported goods, including food, fuel, and other essential commodities. As the cost of living continues to rise, many households may struggle to make ends meet, leading to increased poverty levels and economic hardship.

Businesses are also feeling the impact of the naira’s decline. Companies that rely on imports for raw materials or finished products are facing rising costs, which may force them to either absorb the expenses or pass them on to consumers through higher prices. This could lead to reduced consumer spending and ultimately slow down economic growth.

Furthermore, the depreciation may hinder Nigeria’s export competitiveness. While a weaker naira could make Nigerian goods more affordable for international buyers, the high cost of inputs due to inflation may negate any potential benefits. Additionally, if foreign buyers perceive instability in the currency, they may be hesitant to engage with Nigerian suppliers, impacting trade relationships.

**Government Response and Future Outlook**

In light of the naira’s decline, the Nigerian government and the Central Bank are under pressure to implement measures to stabilize the currency and restore confidence in the economy. Potential strategies may include enhancing foreign reserves through increased exports, attracting foreign investment, and implementing policies aimed at curbing inflation.

Moreover, the government may need to consider a more flexible exchange rate policy that allows market forces to dictate currency valuation while providing a safety net for vulnerable sectors. This could involve a gradual adjustment of the naira’s value to better align with economic fundamentals.

Looking ahead, the future of the naira remains uncertain. As global economic conditions fluctuate and domestic challenges persist, stakeholders will closely monitor developments in the foreign exchange market. Any signs of improvement in foreign reserves, inflation control, and economic stability could play a crucial role in restoring confidence in the naira and stabilizing its value.

Conclusion

The naira’s depreciation to N1,650 per dollar in the official market serves as a stark reminder of the challenges faced by the Nigerian economy. Rising inflation, foreign exchange shortages, and shifting investor sentiment have all contributed to this significant decline. As the government and Central Bank seek solutions to stabilize the currency, the impacts on consumers and businesses will continue to unfold.

Addressing the root causes of the naira’s decline will be crucial for restoring economic stability and ensuring the well-being of Nigerians. With careful planning and effective policy implementation, there may still be opportunities for recovery in the currency market, allowing the naira to regain strength in the face of adversity.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate