The Federal Government has expressed concern over the impact of lower crude oil production volumes on its revenues, which is jeopardizing its ability to achieve the N19 trillion revenue projection in the 2024 budget.

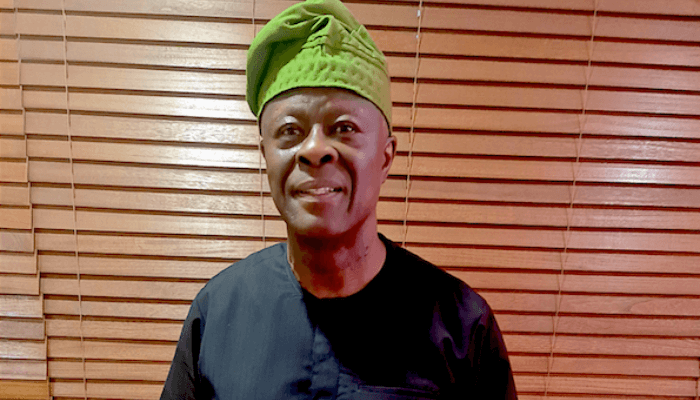

This was outlined in the Accelerated Stabilisation and Advancement Plan (ASAP), developed by the federal government’s Economic Management Team (EMT) Emergency Taskforce (EET), and presented by Wale Edun, the Minister of Finance and Coordinating Minister of the Economy.

According to Minister Edun, the federal government’s retained revenue for January and February 2024 was approximately 60.0 percent of the budget, mainly due to lower crude oil production volumes. He noted that if the current revenue shortfalls continue, the total revenue for 2024 is unlikely to exceed ₦15.8 trillion.

Currently, oil production stands at 1.4 million barrels per day (mbpd), which is below the budget assumption of 1.78 mbpd and the OPEC quota of 1.5 mbpd. This shortfall in oil production has led to federal government revenue shortfalls.

Minister Edun highlighted the challenging economic conditions, including high inflation at 33.7 percent (the highest in almost three decades), high interest rates (Monetary Policy Rate at 26.3 percent), and a volatile exchange rate, which are disrupting economic activity and threatening the bold reforms undertaken by President Bola Ahmed Tinubu’s administration.

To mitigate these challenges, the government has enhanced the ASAP with executive orders focusing on inflation reduction, revenue generation, non-oil export promotion, prudent financial management, and tax information consolidation.

Under the inflation reduction measures, the government plans to:

– Suspend import duties and value-added tax (VAT) on specified items

– Boost the importation of paddy rice by millers

– Peg import duty exchange rates

– Prioritize productive spending

– Enforce executive orders on default approvals

For revenue generation, the government plans to implement measures such as:

– Relief for wage awards and transport subsidies for low-income staff

– Tax deductions for the salaries of incremental staff

– Additional 50% uplift on eligible deductions for transportation and other allowances

– Enable foreign employment for Nigerians as remote workers

Other measures include:

– Tax exemption for repatriated export proceeds of services and intellectual property

– Zero-rated VAT for all non-oil exports

– Relaxation of restrictions on the use of export proceeds

– Removal of tax clearance certificates as a condition for foreign exchange applications

– Introduction of the Tax Information and Collaboration Initiative (TICC)

– Creation of a TICC data bank managed by the Joint Tax Board

– Mandatory use of National Identification Number (NIN) and registered company numbers

– Establishment of the National Tax Data Governance Framework

These measures are aimed at stabilizing the economy, boosting revenue generation, promoting non-oil exports, and enhancing financial management practices amidst the challenging economic environment.

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate