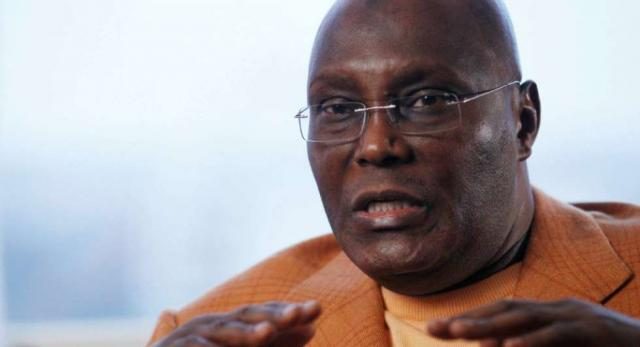

Alhaji Atiku Abubakar made a proclamation that he will privatise Nigerian National Petroleum Corporation (NNPC) if elected President, and that sparked concerns and curiosities in the minds of some Nigerians, so I decided to write this article to explain the entire concept of NNPC privatisation and its effects, so that people will have a better understanding of the intent and the expected outcome of the privatisation.

Allowing individuals to acquire shares in the NNPC with government retaining some of the shares will mean more funding into the corporation to carry out its commercial activities relating to the petroleum industry. The money to be generated as a result of the initial public offering of the NNPC will be used to build roads, railways, public houses and hospitals and to fix electricity problem in Nigeria. With individuals putting their money in the NNPC, wastage and corruptions will be reduced, and employment into the NNPC will not be based on nepotism, but based on necessity and competence.

Nigeria will not lose control of the oil and gas wells and reserves for privatising NNPC; all natural resources will still belong to the federation, and the government decides how to equitably allocate ownership of resources and distribute proceeds from the common resources across the states and local governments. With individual Nigerians becoming shareholders in the NNPC, wealth will be redistributed among Nigerians, thereby reducing poverty. Foreign shareholders will bring foreign capitals into the country, thereby boosting our foreign reserves, improving Nigerian economic strength and strengthening the Naira. As we speak today, Foreign Direct Investment (FDI) in Nigeria has reduced by over 60% in the last two years. Now, Ghana has overtaken Nigeria on FDI scale. If NNPC is privatised, government will then have more revenue from taxing the NNPC for more infrastructural development.

Instead of leaving the NNPC in the hands of mafia, let it be listed so that Nigerians will benefit more. NNPC barely generates N2 trillion in a year, but if it is privatised, it can generate up to N13 trillion in a year, because of the resultant minimisation of costs, leakages and wastage, and maximisation of revenue.

The money to be generated from the equities (NNPC shares) and taxation on the earnings of the NNPC will be used to strengthen new economies in manufacturing, industrial and agricultural sector, so that we will not forever be relying on the declining oil and gas resources. Good to note that, individuals will not be taxed on their NNPC dividends, because Atiku Abubakar promised to end double taxation.

NNPC is one of the inefficient government institutions, with so much political interference, ambiguities, corruption, nepotism and low performance. It needs to be liberalised. Most government corruption originates from the activities that relate to the management of the oil and gas proceeds.

NNPC has been facing challenges in funding upstream operations and obligations, and was not able to raise its potential revenue. Not only in the upstream sector, NNPC failed to effectively manage the downstream sector, which is characterised by scarcities, inconsistent and noncompetitive fuel prices. Despite the abundance of petroleum commodities in Nigeria, the country’s largest import is from the petroleum products, which increases the supply and reduces the value of the Naira in the foreign currency market.

There have been allegations of fraudulent diversion of funds from sales of crude oil, and vague-accounted importations of petroleum products. Some people were alleged to have been paid billions of Naira by the NNPC for importation of nothing.

The NNPC has not provided sufficient refining capacity in the country, which is why greater percentage of Nigeria’s petroleum products are imported. All these happened because NNPC is wholly government owned. If it is a government property, people abuse it, and if it operates at loss or inefficiently, nobody cares, because no external interests are involved. We have seen cases where companies that lack capacities were awarded with oil blocks because they have linkages with the politicians, denying the qualified companies, which is why we have many marginal oil fields in the country. NNPC has lost its international goodwill, because of its inconsistency and political interference, and this has caused doubt and high business risk in the Nigerian oil industry. Though an oil rich country, Nigeria is the world headquarters of poverty, which explains further the poor management of the oil resources in the country.

We have to ask ourselves these questions: “What is wrong?”, and ”What can we do?” A mere reform or removal of subsidy alone will not work. Even if the Petroleum Industry Bill (PIB) is to be passed into law, there will still be problems. For Nigerians to benefit from oil and gas resources, NNPC has to be profit-driven not politically driven, and the best way to do that is to privatise the corporation and allow individuals to buy its shares, so that the company can function like a commercial and profit-driven entity.

Government has numerous responsibilities and interests, and that’s why it cannot efficiently manage the NNPC alone. NNPC requires huge capital investment and independence to make it competitive to other international oil companies like Total, BP and Shell.

If NNPC is privatised, there will be more competition in both upstream and downstream sectors, which will bring down the prices of petroleum products. Privatisation of the NNPC will enable the company to raise more capital to build brand new refineries in Nigeria, which will lead to low petrol price and relieve the Nigerian government from the exorbitant petroleum subsidy payment.

We have seen how privatisation of the telecommunication sector resulted in huge investment in the sector, created more jobs, and made telephones available and affordable. This is what will happen when NNPC is privatised, petrol will be available and affordable.

As we speak today, majority of the oil and gas operation/production are carried out by private oil companies, especially Shell, Chevron, ExxonMobil and Total. NNPC produces only a small fraction of the national petroleum output because of its inefficiency, and yet spends so much on maintenance and other recurrent expenditures. NNPC owes these companies billions of dollars as outstanding Joint Ventures cash calls. This proves that private companies are more effective than public companies. Privatisation of NNPC can see the Nigerian petroleum reserves and output doubled, and natural gas resources optimally harnessed.

As we claim to practice capitalism, the mainstay of the economy should be managed by the efficient private sector. The government should only be responsible for ensuring fair play and providing level playing field for investments to thrive. It is very unnecessary for Nigerian government to keep funding and managing NNPC, while funding infrastructural development and investing on new economies.

Privatisation of national oil companies is a global trend and best practice. Nigeria won’t be the first to do it. Major global oil companies are privately owned; even national companies are now being privatised. BP Oil Company was owned by British government, but later, it was privatised, and it is now one of the leading global oil companies. Countries that have fully or partly privatised their national oil companies include Canada, France, Argentina etc. Even Saudi Arabia and Brazil are seriously considering privatisation of their national oil companies. It is the best thing for Nigeria, as long as we want an economic paradigm shift and achieve real growth. And that is why Alhaji Atiku Abubakar will consult with experts to ensure smooth privatisation of the NNPC, but the government will still retain certain shares of the NNPC. Once NNPC is privatised, it will be relieved from the bondage of the ‘mafia’.

The NNPC Asset Valuation will be done by impartial professionals, who are likely to come from diverse backgrounds and expertise, so as to arrive at the accurate market value of the assets, devoid of discounting, so that Nigerians will benefit optimally from the initial public offering. The privatisation will take place in phases, and may take couple of years to be effected.

“Using a data set of 60 public share offerings by 28 National Oil Companies, it is shown that privatisation is associated with comprehensive and sustained improvements in performance and efficiency. Over the seven-year period around the initial privatisation offering, return on sales increases by 3.6 percentage points, total output by 40%, and capital expenditure by 47%.” Wolf C. and Pollit M.G. (2008). Therefore, it is in the best interest of Nigeria to privatise NNPC as proposed by H.E. Atiku Abubakar. H.E. Atiku Abubakar will embark on inclusive engagement, awareness, consultations, and considerations before embarking on the NNPC privatisation. Nigerians should welcome this development and support Atiku Abubakar when he comes to power to achieve this laudable intention.

Ahmed Adamu, PhD is a Petroleum Economist and University Lecturer. He is also the S.A. to Atiku Abubakar on Youth and Strategy

Support InfoStride News' Credible Journalism: Only credible journalism can guarantee a fair, accountable and transparent society, including democracy and government. It involves a lot of efforts and money. We need your support. Click here to Donate